Tyler Winklevoss, the co-founder, and CEO of the crypto exchange Gemini and one of the earliest BTC adopters believes that Ethereum’s price is a “steal” now. He noted that the second-largest cryptocurrency is still about 50% away from its all-time high.

Winklevoss: Buying ETH Now Is A Steal

Ethereum is among the best performers through this challenging year. Whether it was the DeFi craze or the long-anticipated ETH 2.0 launch, the asset has exploded by nearly 500% from $130 at the start of 2020 to the recently charted YTD high of $760.

Despite surging significantly more than BTC percentage-wise, ETH was unable to mimic bitcoin in registering a new all-time high. In fact, Ether is still a long way from its highest level, marked in January 2018 of $1,450 (according to CoinGecko data).

ETH’s price, being roughly 50% away from that level, has caught the attention of the early Facebook investor – Tyler Winklevoss. He classified the option to buy ETH at this level as a “steal” and compared it to purchasing BTC at $14,000 – slightly over 50% of bitcoin’s latest all-time high.

The price of ether $ETH right now is $735. This is 51% off of its all-time-high, which is like buying #Bitcoin at 14k. What a steal.

— Tyler Winklevoss (@tyler) December 31, 2020

Ethereum Whales Accumulate

And while Winklevoss might be expecting an additional price surge for ETH, it seems that Ethereum whales have been preparing for such a scenario with massive purchases.

The analytics company Santiment breached data that the number of ETH address holding at least 10,000 tokens has increased by 39 wallets in the past two months alone.

ETH Retail/Whale Hodlers. Source: Santiment

At the same time, Santiment said that retail investors had done the opposite. Addresses containing between 100 and 10,000 ETH tokens have been gradually decreasing since mid-November 2020. Furthermore, the number of relatively small wallets holding between one and 100 Ethers has plummeted before Christmas, as the graph above demonstrates (the purple line).

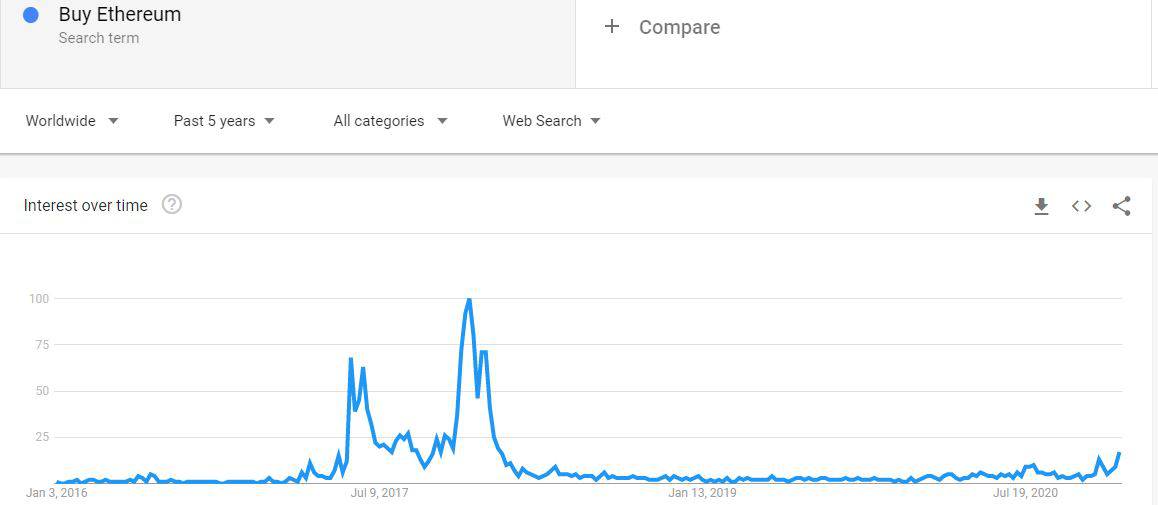

Google Trends, which is typically a good indicator of retail investors’ behavior, suggests that the term “buy Ethereum” has reached a yearly high this week following ETH’s YTD price record. Nevertheless, the interest from such investors is still far away from the 2017/2018 craze.

“Buy Ethereum” Google Searches 5-Year Back. Source: Google Trends

Featured Image Courtesy of Yahoo

Title: Tyler Winklevoss Eyes ETH: Buying Ethereum Now Is Like Buying Bitcoin At 50% Discount

Sourced From: cryptopotato.com/tyler-winklevoss-eyes-eth-buying-ethereum-now-is-like-buying-bitcoin-at-50-discount/

Published Date: Thu, 31 Dec 2020 09:30:49 +0000

Tyler Winklevoss Eyes ETH: Buying Ethereum Now Is Like Buying Bitcoin At 50% Discount